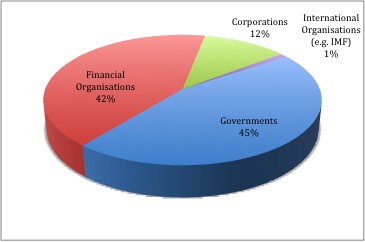

1. The total size of the global debt securities market: $98.4 trillion

Data compiled by the Bank for International Settlements, http://www.bis.org/statistics/intfinstatsguide.pdf

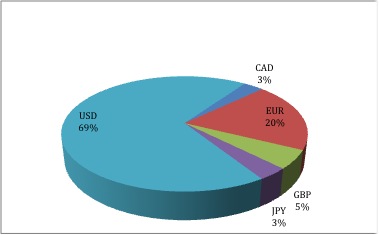

2. Over two thirds of corporate bonds outstanding are in US dollars

… of which only 64% were actually issued in the US. That still means that nearly half of all corporate bonds are issued in the USA. The split is: USA 47%, Eurozone 20%, Japan 9%, China 6%, UK & Canada 3% each. (Source: Merrill Lynch Global Broad Market Corporate Index (MLGBMCI), excluding financials, was used as a proxy for the global corporate bond market in order to estimate splits by credit ratings, currency and sectors.)

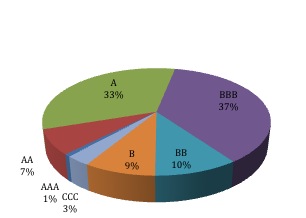

3. 78% of corporate bonds have an investment grade credit rating

Capital-intensive industries account the majority of issuance with Utility, Energy, Telecommunications, and Basic Industry sectors the largest issuers.

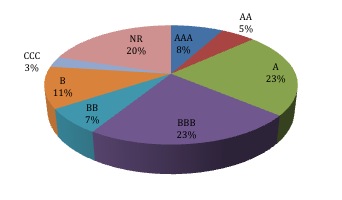

4. Nearly 50% of corporate bonds issued last quarter were BBB or A rated

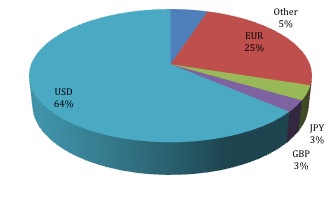

5. Two thirds of June Quarter corporate bonds were in USD

There were approximately 849 new developed market corporate bond issues during the June 2012 quarter, raising over $414 billion.

Source: bond issues greater than $50m, listed on Bloomberg.

6. Money continues to shift from equities to bond markets

U.S. long-term mutual funds experienced $44.9 billion net inflows over the quarter (Source: Investment Company Institute). Despite the return in risk appetite, investors continued to move out of equities and into bond funds, with $19.1 billion coming out of equity funds and $58.9 billion of net inflows to bond funds over the period.

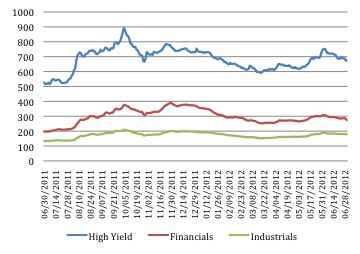

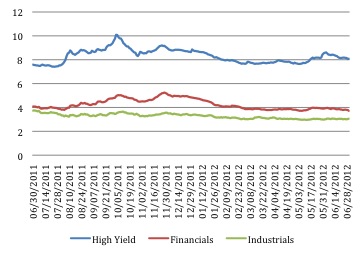

7. Credit spreads continue to tighten ...

... and yields keep declining: the markets think we're set for low growth and low inflation

Source: ML Global Broad Market Indices