Taxonomy - What we do

Our Taxonomy Team works to get best practice green finance principles spread across the world. As the green bond market grew in prominence over recent years it began influencing the conscience of national finance and policy regimes, and the taxonomy became new gambit to combat greenwashing. Having long been influential in green bond standards, Climate Bonds seeks to scale up its influence on these frameworks through a growing Taxonomy Team that provides techincal assistance to new taxonomy development programs across the world. Climate Bonds has its own Taxonomy which is used to guide ambitious and credible standards across the world.

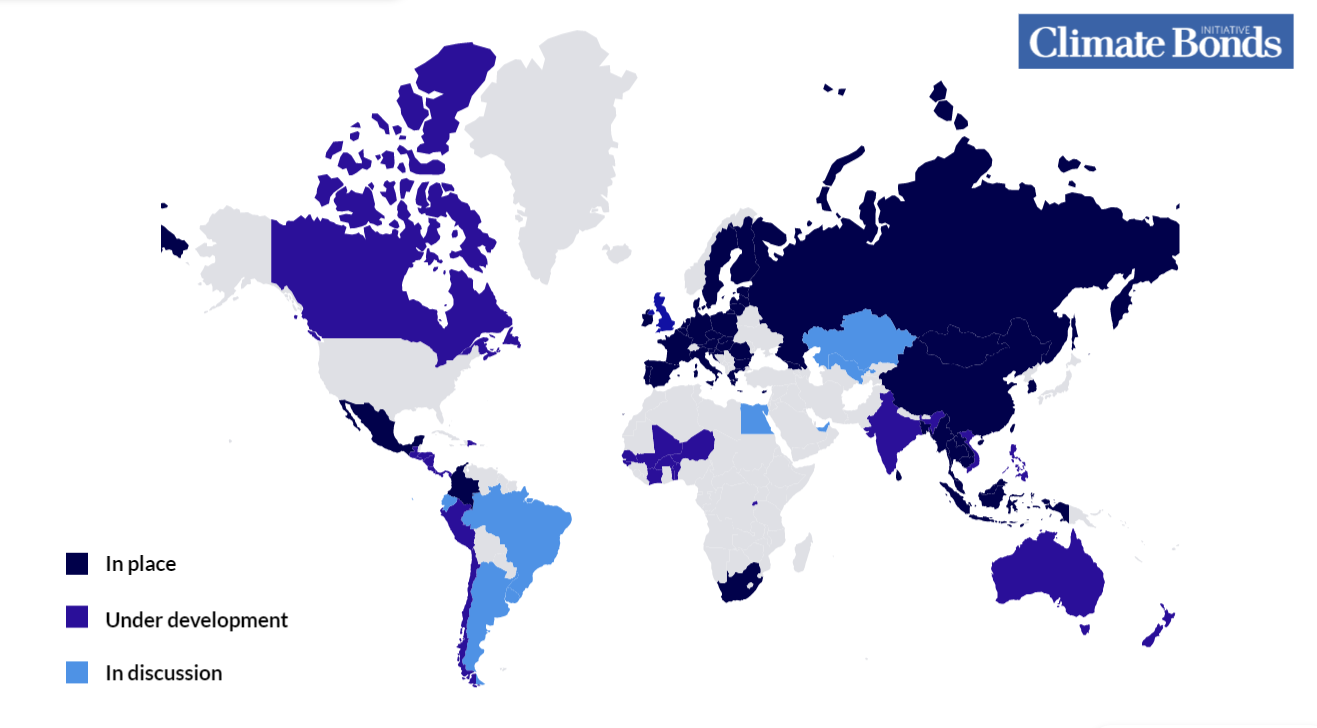

Taxonomies Have Spread Across The World

10 years ago, the idea of a 'Taxonomy' had barely entered into the finance vernacular, now they are a must have for any nation serious on climate capital . Taxonomies have spread across a number of countries in every continent. They act as a shopping-list for a green future, helping to spur green finance, and ensure investors can be confident about the quality of their green investments. Climate Bonds has been honoured to provided technical assistance for several of the taxonomies that have been developed across the world. Even today our taxonomy department continues to help develop more and more new taxonomies.

Taxonomies Help Grow Local Markets

Taxonomies encourage more capital for climate solutions; they are a statement that green finance here is a credible regime with a future ahead of it. Globally, Climate Bonds is working to mobilise $5trillion of annual green bond issuance by 2025. The climate challenge ahead requires nothing short of a complete overhaul of the large swathes of the global economy. In order to get annual issuance into the trillions per year, we need strong local efforts. Taxonomies are crucial to the groth of local markets and Climate Bonds' Taxonomy Team is here to support such efforts.