Climate Bonds Blog

From Colombia to Peru to New York: we are back at in-person events! Check out below.

We will continue to share our monthly schedule of events with you. See below how you can stay connected with us!

From Mexico to Copenhagen to Australia: While our staff will not be speaking at physical events, they will still be appearing.

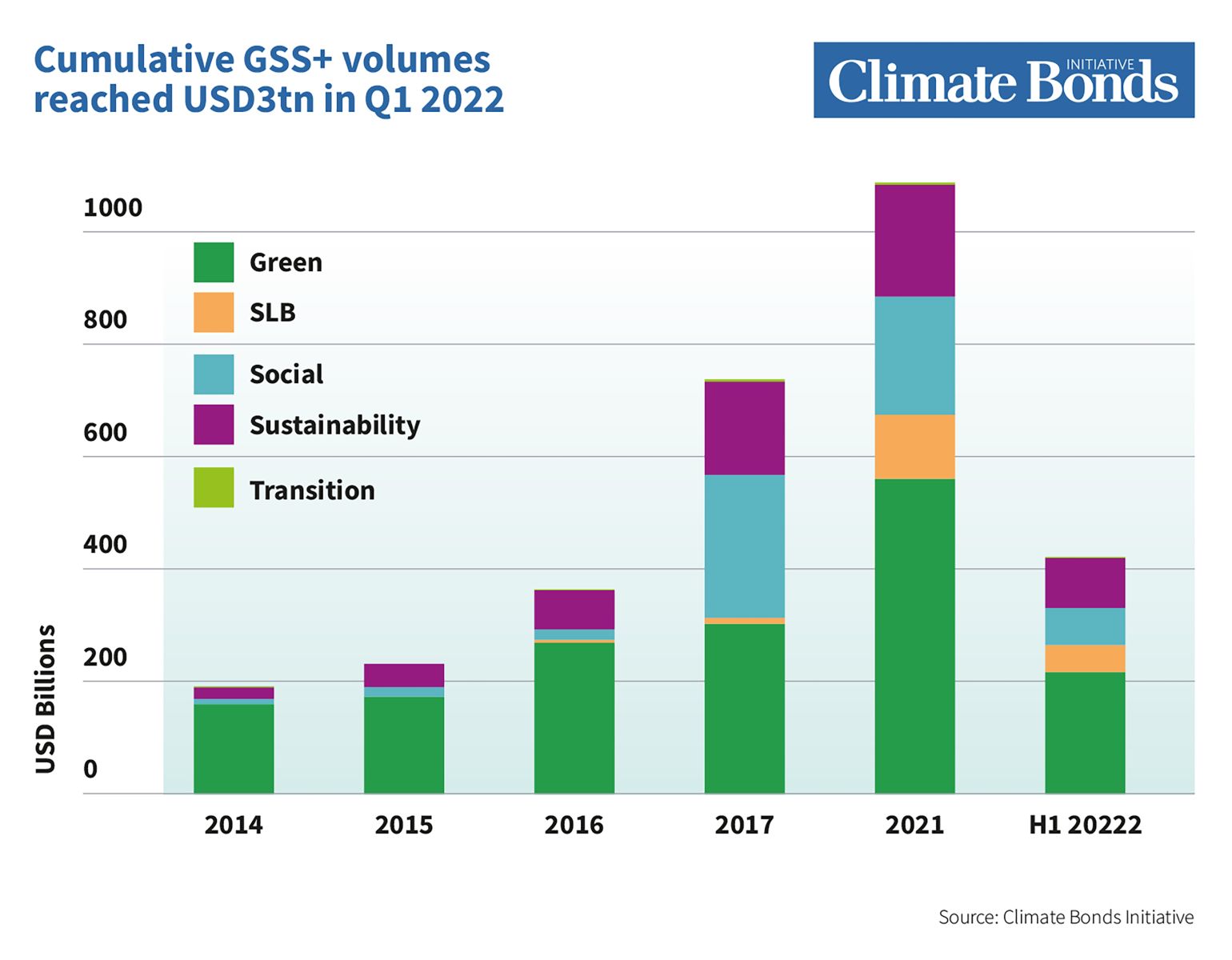

Green and other labelled bonds reach $417.8bn in the first half of 2022

Green, social, sustainability, sustainability-linked, and transition (GSS+) labelled debt reached a combined volume of USD417.8bn in the first half of 2022 (H1 2022), representing a year-on-year (YoY) decrease of 27% against H1 2021. However, signs of a revival emerged as green issuance picked up in Q2, increasing by 25% on Q1 volumes with a total of USD121.3bn.

Ambiciones planteadas para los criterios existentes - Actualizaciones adicionales previstas para finales de este año