Breaking Throught the Energy Efficiency Logjam

The Climate Bonds Initiative is proposing bond issuance for municipal emission reduction, national renewable energy programs and developing country adaptation efforts.

This page focuses on municipal emission reduction programs.

Climate Bonds for Municipal Emission Reduction Programs

Aims:

- Using private finance to create a rolling programme of energy efficiency and micro-generation

- To end energy poverty

- To provide energy security for the country

- To create green jobs

Background & benefits of energy efficiency

In Iceland homes commonly use geothermal energy for heating. A rather shocking experience for the energy conscious climate campaigner is to visit an Icelandic home for dinner, and have the windows flung open when the room gets too hot — there is no shortage of energy when you’re sitting on top of hot rocks.

In theory there is no shortage of renewable energy anywhere in the world: reports have recently appeared claiming that China has enough wind resources to power its whole economy and more[1]; Australia has enough geothermal to fuel the country’s economy for 100 years[2]; and a series of large scale solar thermal plantations in the Sahara could keep the lights on in the whole of Europe and North Africa[3]. But the job of economically harvesting enough of that energy will take time; in the meantime we need to rapidly reduce energy demand as part of turning our emissions trajectory downward and to buy time while we retire our polluting energy sources.

Energy efficiency is a win-win idea: investment in reducing energy demand invariably has a relatively quick payback period, so the financial drivers are in theory clear.

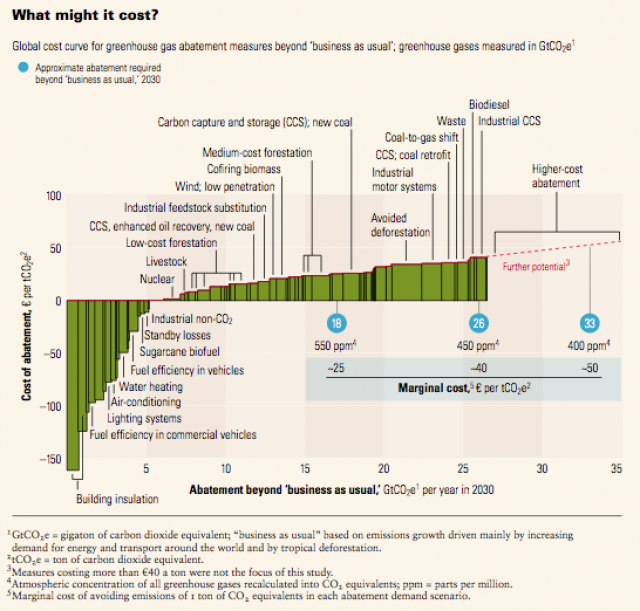

According to the McKinsey/Vattenfall abatement cost-curve[4] (see illustration below), improving energy efficiency in buildings is the low-hanging fruit of climate change mitigation — it will provide the fastest return on investment of options available.

Yet, as economists such as Prof. Dieter Helm have noted[5], “In practice energy efficiency has not had a significant take-up and, in particular, individuals and companies have not been noticeable in their adoption of the claimed positive-NPV investments.” McKinsey has also noted this shortfall in their report on Unlocking Energy Efficiency in the US Economy. [6]

Across all sectors of the economy energy efficiency is not delivering on the scale of its promise. The lack of progress is particularly an issue in the home or small business sector, where all sorts of energetic companies have been active and where many innovative financing solutions have been trialled.

Many governments have been mandating energy efficient building standards, and developing modest programs to support retrofitting of existing building stock. This is beginning to make a difference to new construction, although in most countries new construction only accounts for a small proportion of properties. But to avoid run-away climate change we need to dramatically and rapidly improve the efficiency of 80-90% of existing building stock.

So why haven’t savings benefits driven rapid take-up of energy efficiency options?

Some commentators argue that a lack of available finance is a barrier to take-up. The UNEP Finance Initiative Working Party on Energy Efficiency, for example, identified in its report on Energy Efficiency and the Finance,Sector [7] “a lack of commercially available financing” as a barrier. The UK Green Building Council’s Pay As You Save Report proposed financing solutions as a means of increasing take-up.

In theory, the capturable financial outcomes in the form of reductions on energy bills should be a clear candidate for debt financing. This, for example, is what underpins the idea of Energy Service Companies (ESCOs), which have had modest success in the US commercial property sector.

However, as the UNEP FI report[8] notes, “individual (energy efficiency) projects are considered too small to be commercially ‘interesting’ to mainstream private sector financial institutions.”

Given that capital resources are greatest in the institutional investor sector, a requirement for gaining access to required capital will be effectively aggregating energy efficiency projects into investible scale opportunities. The scale of retrofit required would suggest this might be possible.

But the slow-take-up of energy efficiency to date suggests the economic case is not as clear as it’s meant to be.

We suggest that a weakness in the McKinsey/Vattenfall cost curve is that the “transaction cost” is not adequately factored in. That is, existing practice in the energy efficiency sector requires much higher sales and customer handling costs than have been suggested.

Behavioural economics has shown that, for individuals being called on to make a household or small business-level decision, there can be a major inertia factor when faced with complex decisions that deliver relatively marginal immediate benefit, despite a rational case for longer-term savings. In that context, a huge and very costly effort to educate and sell to individuals at home or work becomes necessary.

Finally, financing energy efficiency has been complicated by the disaggregated nature of solutions delivery. Energy efficiency may be just six compact fluorescent lamps for one house, $500 of ceiling insulation in another, or $5000 of advanced lighting controls in an office. It’s fiddly to install which means that, while it offers extremely low risk of technology failure, it can be complicated to finance on a small scale. Loan offers that have been focused on households and small businesses consequently have high servicing costs.

We propose delivering investibility and scale through large, government organised schemes, instead of relying on the expensive marketing effort of convincing householders one by one.

The driver is to aggregate the work and put it into a reduced risk framework that will lend itself to bond financing.

These would be structured so as to be suitable for financing with municipal or national bonds, or with corporate (ESCO) bonds secured by purchase contracts from government. (In the US, asset-backed municipal bonds will have particular tax advantages for investors). Returns will come from loan repayments tied to dwellings, either via municipal tax bills or utility bills.

Aggregation would deliver two further important benefits:

- Opening up options for local facilities such as neighbourhood energy generation or community heat-pumps.

- Using the cost-efficiencies that come with scale to reduce per-unit costs.

How an opt-out model would work

Schemes would have the following characteristics:

The use of an opt-out model

An opt-out approach allows large-scale projects that will dramatically cut transaction and building costs and makes projects more attractive to institutional investors, lowering the cost of funds and increasing the pool of prospective investors. Reduced costs mean much more refit can be delivered per dwelling than with current schemes.

An opt-out scheme would mean that Governments automatically enrol whole areas in programs – neighbourhoods for residential energy efficiency, CBD blocks for building or office-tenancy upgrades, industrial zones for industrial energy efficiency.

Individuals and businesses have the right to opt-out: they are told they’re included but asked if they want to drop out. This is in contrast to current models where individuals are required to make a positive decision to do something about energy efficiency – an “Opt-in” model.

Effectively, a municipality enrols local households in a “bulk purchase scheme” as part of “solving problems for its citizens". It means “lower costs for everyone”, no effort required for householders apart from letting people in to do the work, their neighbours are all in as well, and if they do let the workmen in they get savings on their energy bills - they pay LESS not more.

As well they could be offered a modest cash payment up front for the inconvenience of workman being in their house. The payment would be recouped from the dwelling-attached loan.

An assessor would visit premises and make recommendations for action. Separate teams would undertake works once householders have signed off.

An opt-out scheme could make the difference between 25% and 85% participation and deliver aggregation of effort that will reduce roll-out costs as well as scale refit projects up to become more investable.

Not only would this approach deliver results through competitive tendering; it would also deliver through peer competition, at the residential or business level. Research has shown that householders are more willing to participate in energy efficiency refits if their neighbours are doing so as well[9]. Under the opt-out scheme, whole neighbourhoods would be done at the same time.

If a householder opts-out, they would still be able to organise their own retrofit and, subject to compliance with a set of public standards, take advantage of the loan program available. But it’s unlikely the deal would be as good if they went it alone.

Householders can choose to opt-out and not to take action. However, if at some stage they sell their house they would be required to get an energy efficiency compliance certificate for their dwelling, so that the relative level of its energy efficiency is fully disclosed to prospective new owners.

Legislative changes may be required to achieve an opt-out scheme.

Financed with Climate Bonds

Climate Bonds would be issued by either the municipality, or by ESCOs using the security of a purchase contract from a municipality.

This will be facilitated through local authorities. Local authorities issue a Climate Bond in the market. The bond is a standard 10-15 year fixed payment bond, but it is collateralised against household payments and guaranteed by the local authority. Households would be automatically enrolled into the energy efficiency scheme, although they would have the right to opt-out. An assessor would visit the household and arrange for energy efficiency work to be carried out by an ESCO.

An alternative to the local authority issuing the Climate Bond, would be for them to support ESCO’s in raising capital through corporate bonds, secured by local authority purchase contracts under the scheme and with the collections system guaranteed by the local authority or national government.

A useful model for bond financing has been developed by the Californian City of Berkeley, with its Financing Initiative for Renewable and Solar Technology[10] (FIRST) scheme. While the scheme is limited in local effectiveness by its “opt-in” nature (opt-out schemes are not currently allowed under the Californian Constitution), the repayment model is a useful one. It uses long-dated municipal bonds as a financing source, with repayments provided by charges against dwellings, linked them to the specific energy assets created under the scheme.

Repayments would be via a loan charge tied to an individual dwelling.

Repayments would be collected either through utility bills (as per various policy proposals in the UK at present) or via Council or municipal taxes; repayments would be tied to the dwelling rather than the residents. As people move out or change their utility provider, repayment charging would shift accordingly — the repayment is shifted to the new occupier.

The UK Green Building Council’s Pay As You Go report[11] includes a useful outline of the pros and cons of utility bills and Council tax options, and how the mechanics of these would work.

Households are guaranteed savings on their energy bills.

Repayments are linked to the property over an extended period of time and are calculated to be less than the savings that will be made on household energy bills.

n US, trials of loan schemes found that an important means of getting householders to accept schemes has been to enshrine the idea that the householder saves money.

Typically, the loan repayment charge can be no more that 75% of energy bill savings. That means that householders keep 25% of any energy savings — without having to do anything except let assessors and then workmen into their house.

Use incentives tied to CO2 emission reductions.

At present contractors are paid for building work or, in the case of utilities, for nominal emission reductions calculated in the crudest fashion, with no verification. As the UK Green Buildings Council has observed, building focused refits often see energy use rise, or “bounce back”, after a refit until the same cost levels as before are reached.

We propose that the mix of remuneration for ESCOs include incentives tied to the reduction of greenhouse gas emissions. Geographical area baselines could be developed from existing local authority indicators or where smart metres have been installed.

The aim will be to allow ESCOs to think creatively about how best to reduce emissions over a 5+ year period, and to encourage competition between different ESCOs to find creative ways to emissions. This program would best suit well-capitalised ESCOs with the capacity to also export their services to other areas.

While an ESCO would look at building insulation measures, they might also consider micro-generation, heat pumps or even behaviour modification.

Higher-grade smart metres might be installed: for example, tests in Japan and Australia with ultra-smart meters show that significant energy use reductions can be achieved with simply making it very obvious where energy is being used in the house.

By providing sufficient scale of territories contracted to an ESCO, and including potential access to Council or community space in those territories, we open up the opportunity to include communal solutions where they most carbon and energy efficient. Communal solutions could range from larger scale heat pumps in Council car parks that serve a wide area, to neighbourhood solar, wind or biomass facilities.

The point is to focus outcomes on both sustained energy use reductions (and thus consumer savings) and emission reductions, rather than the currently common roll-out of insulation that may or may not lead to emission reductions. Of course emissions tracking will be a pre-requisite for such an approach; in many countries (e.g. Italy, the UK) this is already happening; in other jurisdictions it would need to be factored in to the program.

A competitive market for Energy Service Companies.

Governments or municipalities would run tenders for the area-by-area energy efficiency programs, as has been done through various demand management program in the United States, for example.

Tenders would be designed to provide adequate scale for ESCOs to aggregate refit projects and keep unit costs low, while ensuring a competitive market of tenderers.

The visible participation by local government, both as managers of programs and as verifiers of work carried out, will be important to ensuring trust in the program among building owners.

The opt-out aspects of the above proposals will require government leadership of a substantial order. We believe a central component of a strategy to maximize support and mitigate the political risks will be to trial proposals with receptive municipalities, and ensure that outcomes — notably reductions on energy bills — are well-explained.

Comment

There are certain features of this policy which might seem surprising but are the best alternative. Firstly involvement of local authority; it is important to stress that the local authority enables the programme, but the capital raised is from the private sector and delivery is by ESCOs.

It has been shown both by theory and practice that utility companies are set up to sell energy, therefore they will be reluctant participants in any scheme; we need to create a new market where new companies will survive (e.g. think IT 30 years ago, we do not want to rely on IBM to deliver internet services, we want to create the environment for the new Google).

The opt-out scheme is the only way of achieving scale. The alternatives are new coal power, the lights going off and/or very high energy prices, combined with massive infrastructure spend and the householder will win financially.

It’s worth noting that Richard Thaler[12] has found in his studies of health plans in the US that opt-out schemes are more politically popular than fully voluntary schemes.

The program is ongoing, as ESCOs learn-by doing and new technology comes on line, households are continually upgraded.

[1] McElroy, M., Lu, X.,* Chris P. Nielsen, C., Yuxuan Wang, Y. Potential for Wind-Generated Electricity in China, Science Magazine 11 September 2009: Vol. 325. no. 5946, pp. 1378 – 1380. See also http://www.livescience.com/environment/090910-china-wind.html

[2] Flannery, T., The Weather Makers-The History and Future Impact of Climate Change, p276. 2005, Text Publishing

[3] See http://www.desertec.org/en/concept/studies/

[4] Enkvist, P., Nauclér, T., Rosander, J.. A cost curve for greenhouse gas reduction: A global study of the size and cost of measures to reduce greenhouse gas emissions yields important insights for businesses and policy makers — Exhibit 1. February 2007, McKinsey Quarterly. http://www.mckinseyquarterly.com/A_cost_curve_for_greenhouse_gas_reducti...

[5] Helm, D., Climate-change policy: why has so little been achieved? Oxford Review of Economic Policy, Vol 24 No 2, 2008, pp. 221-238

[6] Granade,, H.C., Creyts, J., Derkach, A., Farese, P., Nyquist, S., Ostrowski, K., Unlocking Energy Efficiency in the US Economy, McKinsey & Company, July 2009

[7] Energy Efficiency and the Finance Sector — A survey on lending activities and policy issues. By Kirsty Hamilton. UNEP Finance Initiative Working Party on Energy Efficiency, January 2009.Energy Efficiency and the Finance Sector — A survey on lending activities and policy issues. By Kirsty Hamilton. UNEP Finance Initiative Working Party on Energy Efficiency, January 2009.

[8] Ibid

[9] Discounting Future Green: Money Versus the Environment, Hardisty and Weber, Journal of Experimental Psychology: General, vol 138, p 329, http://davidhardisty.info/downloads/2009-DiscountingFutureGreen-Hardisty... and Dormitory residents reduce electricity consumption when exposed to real-time visual feedback and incentives, Petersen, Shunturov, Janda, Platt and Weinberger, Oberlin College, Lewis Center for Environmental Studies,International Journal of Sustainability in Higher Education, vol 8, p 16). http://www.luciddesigngroup.com/download.php?id=20070117

[10] http://www.ci.berkeley.ca.us/ContentDisplay.aspx?id=26580

[11] UK Green Building Council, Pay As You Go — Financing low energy refurbishment in housing. August 2009

[12] Thaler, R.H., Sunstein, C.S., Nudge: Improving Decisions About Health, Wealth, and Happiness, New Haven and London: Yale University Press, 2008.