The 'Bonds & Climate Change: State of the Market 2016' report is an in-depth analysis of the climate-aligned and labelled green bond markets.

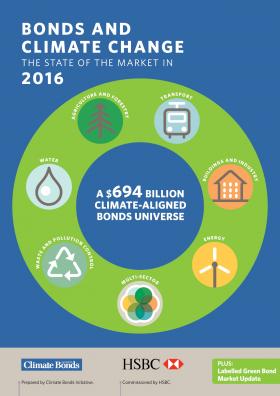

This year’s analysis estimates that there are $694bn of climate-aligned bonds outstanding, an increase of $96bn on last year’s report.

This total is made up of approximately 3,590 bonds from 780 issuers across our climate themes: Transport, Energy, Buildings & Industry, Water, Waste & Pollution and Agriculture & Forestry.

It includes $118bn of labelled green bonds.

>> Download the report (A4 version / A3 version)

>> Spanish Language - Lengua Española

(A4 version / A3 version)

>> Read the Blog post

This year, our 20-pages State of the Market report has a new layout, and notably includes:

› 6 pages of in-depth thematic analysis

› Separate sections on US municipal bonds and China

5 key takeaways of the report:

1. As of May 31st 2016, the outstanding climate-aligned bond universe amounts to $694bn. The labelled green bond market makes up 17% of this universe.

2. Findings indicate a huge potential for the climate-aligned bond universe: $694bn in a $90trn bond market, when $93trn investment is required across the whole economy by 2030 for a 2°C world scenario.

3. In the $694bn universe, the dominant theme is transport (67% of the total amount outstanding), followed by energy (19%) and multi-sector (8%).

4. In the climate-aligned bond universe, the Chinese currency is dominant (with 35% of the total amount outstanding), followed by the US dollar (24%) and the Euro (16%).

5. 78% of the universe is investment grade; the majority of bonds have tenors of 10 years or more; the majority is also government-backed.

Country Specific Editions

Download the Brazil Edition

4 extra 'Spotlight on Brazil' pages

(Versão em Português / English)

Descargar el capítulo especial sobre México

Télécharger la brochure en français